One unified verification layer for every customer type

Minimize risk of misrouted funds

Businesses face a 50% incorrect IBAN entry rate. With Lean's Account Verification solution, you can bring this down to 0%.

Avoid fraud and AML risk

Verify that your KYC'd customer is the owner of their bank account using Account Verification, minimizing chance of fraud.

Improved customer and client experience

Eliminate manual efforts, over 90% time saved with automated verification, less than 10% cases need manual review.

Verify an account instantly

Account Ownership

Lean verifies that a bank account belongs to the intended individual, freelancer or business, ensuring payments, payouts, and disbursements are sent to the correct account every time.

Verify the ownership of individuals and business accounts

Retrieve the account holder name of verified accounts

Support for domestic accounts and over 50 countries

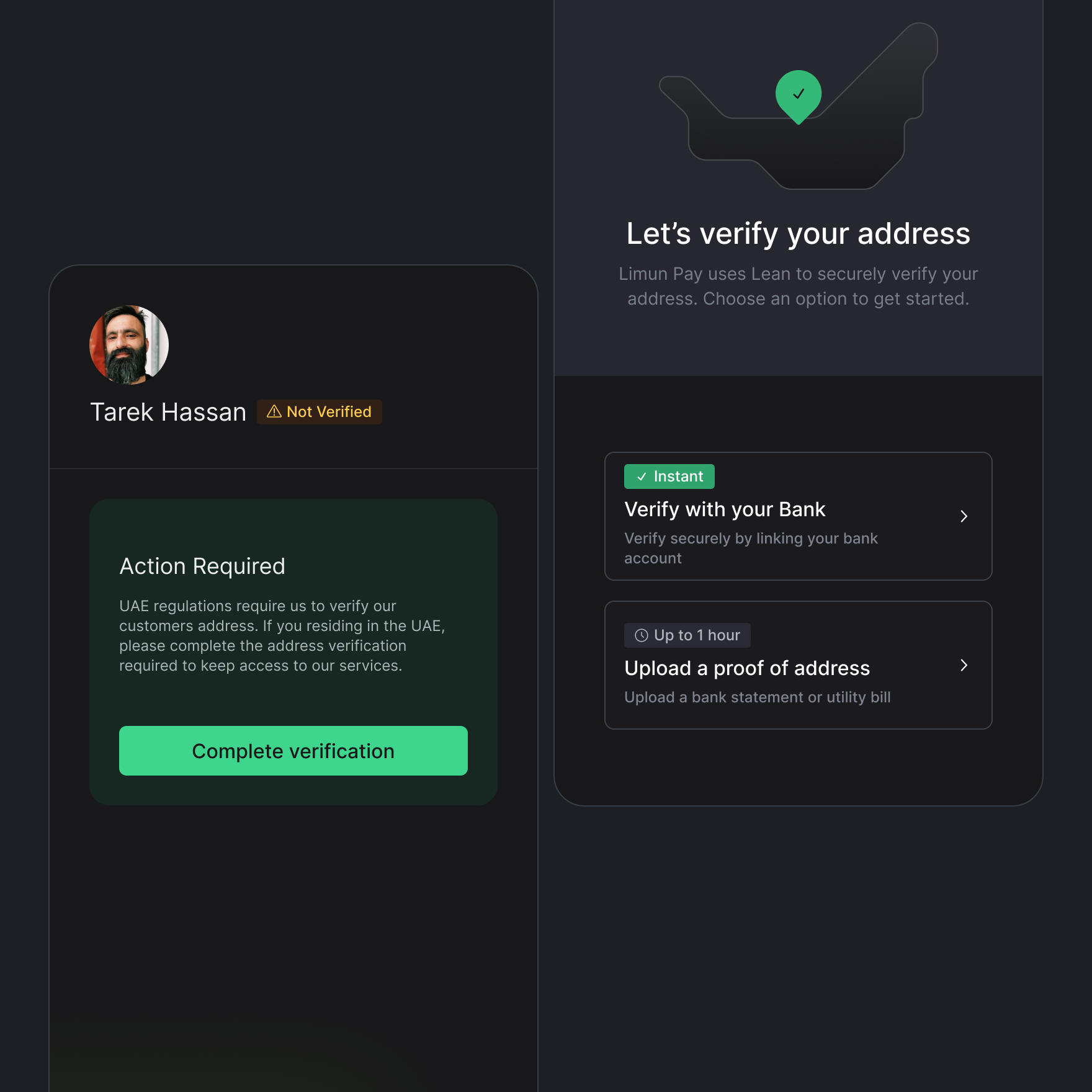

Address Verification

Lean verifies customer addresses using bank data or valid documents within a single journey, giving businesses reliable address verification without friction.

Obtain verified address details from bank data

Compliant with regulatory address requirements

Supported document verification as redundancy

Open Finance in action

Explore what it’s like to use Open Finance to pay by bank as an end-user and understand the interactions between your app, Lean, the banks, and our APIs.